Pay stubs are more than just a record of earnings—they serve as a vital tool for both employees and employers to track work hours, overtime, and sick leave.

Understanding how pay stubs reflect these details can help businesses stay compliant with labor laws, ensure employees are compensated accurately, and provide transparency in workplace management.

This article explores the ways pay stubs help track overtime and sick leave, why they matter, and best practices for employers and employees.

Understanding Pay Stubs

A pay stub, also known as a paycheck stub or earnings statement, is a document provided by employers that outlines an employee’s pay for a specific period. It typically includes:

- Gross wages: Total earnings before deductions

- Net pay: Amount received after deductions

- Taxes and deductions: Federal, state, and local taxes, insurance premiums, retirement contributions

- Work hours: Regular hours worked and overtime hours

- Leave balances: Sick leave, vacation, or PTO (Paid Time Off)

Pay stubs act as a transparent record that reflects both monetary compensation and time-based benefits, making them essential for managing employee payroll accurately.

Tracking Overtime Through Pay Stubs

Overtime occurs when employees work beyond their standard work hours, typically exceeding 40 hours per week for hourly employees in the United States. Accurate tracking of overtime is crucial for compliance with labor laws and fair compensation.

How Pay Stubs Reflect Overtime?

Most modern pay stubs include a dedicated section for overtime hours. This section usually displays:

- Total overtime hours worked during the pay period

- Overtime pay rate (often 1.5 times the regular hourly rate)

- Total overtime pay earned

By documenting overtime on each pay stub, employees can verify that their extra hours are compensated correctly, and employers can maintain a record for auditing and payroll purposes.

Benefits of Overtime Tracking via Pay Stubs

- Transparency: Employees can see exactly how many overtime hours they worked and how they were paid.

- Compliance: Employers can ensure adherence to federal and state overtime regulations.

- Payroll accuracy: Reduces errors in overtime calculations, preventing disputes.

- Data for management: Employers can analyze trends in overtime to manage workloads and staffing efficiently.

Common Mistakes to Avoid

Even with pay stubs, mistakes can happen. Employers should ensure that:

- Overtime hours are correctly recorded in the payroll system

- The correct overtime pay rate is applied

- Exempt employees are not incorrectly charged for overtime

By carefully reviewing pay stubs, employees can identify discrepancies and address them promptly.

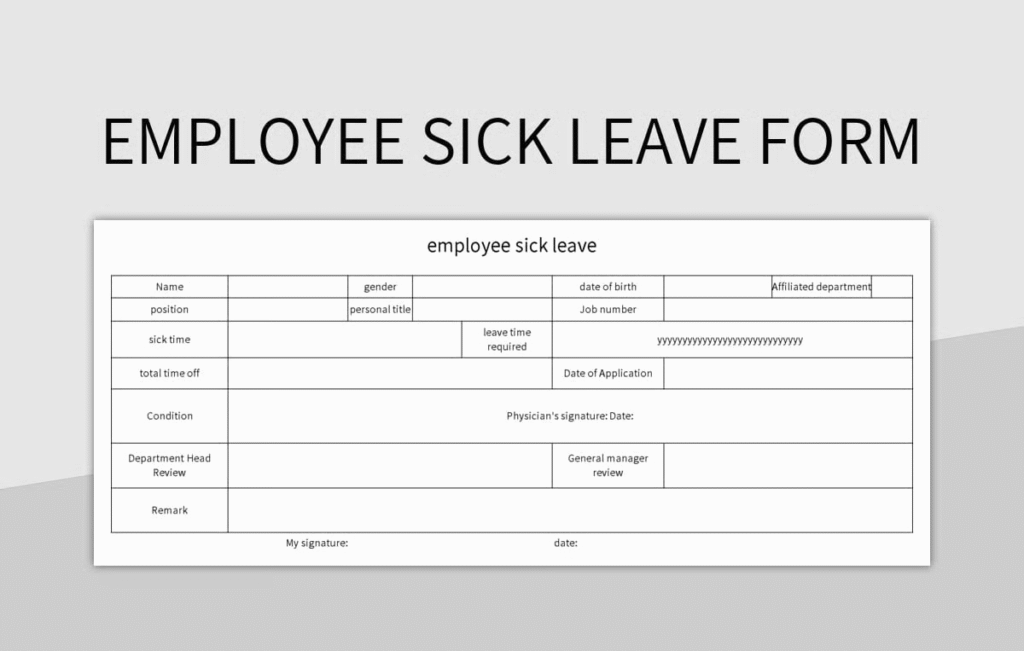

Tracking Sick Leave Through Pay Stubs

Sick leave or Paid Time Off (PTO) is another crucial aspect of employee benefits. Pay stubs serve as a record of how much sick leave has been accrued, used, or remaining.

How Pay Stubs Reflect Sick Leave?

Modern pay stubs often include a section for leave balances, showing:

- Accrued sick leave: Total hours earned based on company policy

- Sick leave used: Hours taken in the current pay period

- Remaining sick leave: Updated balance after deductions

This information allows employees to track their available sick leave without relying solely on HR or payroll departments.

Benefits of Sick Leave Tracking via Pay Stubs

- Employee awareness: Employees know their available sick days and can plan time off accordingly.

- Compliance: Helps employers comply with local labor laws regarding sick leave accrual and usage.

- Payroll transparency: Reduces confusion or disputes over leave balances.

- Recordkeeping: Provides an official document for audits or disputes.

Common Challenges

Employers need to ensure sick leave tracking is accurate by:

- Updating balances after every pay period

- Accounting for partial-day absences or late arrivals

- Differentiating between sick leave, vacation, and unpaid leave

Accurate pay stub records minimize potential conflicts and improve employee satisfaction.

How Digital Pay Stubs Simplify Tracking?

In today’s digital workplace, many companies use payroll software that automatically generates pay stubs with detailed overtime and sick leave information. Digital pay stubs offer additional benefits:

- Real-time updates: Employees can access their pay and leave balances instantly.

- Reduced errors: Automation minimizes manual entry mistakes.

- Accessibility: Employees can download or print their pay stubs anytime.

- Integration with HR systems: Streamlines leave tracking, payroll, and benefits management.

By leveraging digital tools, employers can save time, ensure compliance, and provide a seamless experience for employees.

Best Practices for Employers

To make the most of pay stubs for tracking overtime and sick leave, employers should:

- Provide detailed pay stubs: Include separate sections for regular hours, overtime, and leave balances.

- Update records regularly: Ensure payroll systems reflect the latest work hours and leave usage.

- Educate employees: Explain how to read pay stubs and understand overtime and sick leave calculations.

- Maintain compliance: Follow local labor laws regarding overtime pay and leave accruals.

- Encourage regular review: Ask employees to check their pay stubs each period for accuracy.

Best Practices for Employees

Employees also play a role in ensuring pay stubs accurately reflect their work and leave. They should:

- Review pay stubs every pay period

- Confirm overtime hours match their timesheets

- Track sick leave usage and report discrepancies

- Keep copies for personal records and tax purposes

- Communicate promptly with HR if errors are found

Proactive tracking empowers employees to manage their pay, leave, and benefits effectively.

Conclusion

Pay stubs are essential tools for tracking overtime and sick leave. They provide transparency, ensure compliance, and help prevent payroll errors. By understanding how overtime and sick leave are recorded, employees can ensure they receive fair compensation, while employers can maintain accurate records and improve workplace efficiency.